Support at Home fund consumption models and API integration

This guide will help you understand how your system connects and updates with key external data sources. You’ll learn when and how syncing occurs, what information is updated automatically, and how to manually refresh records if needed. We’ll also walk through testing procedures and highlight known issues, so you can stay confident that your data is accurate and up to date.

Syncing with the APIs

Your data automatically syncs with the APIs every day at around 2:00 AM (AEST).

You’ll always see the most recent sync time displayed, so you know when your data was last refreshed.

The sync process updates key information such as:

- Subsidy and supplements

- Client contribution percentages

- Care management deductions

- Funding sources (including home care account residual funds and provider-held Commonwealth funds)

Details about testing steps and known issues can be found in the relevant sections below.

Understanding fund consumption in Support at Home

Support at Home now has updated rules for how funds are used, and these rules differ depending on the type of funding:

Ongoing funding (non AT-HM):

- Participant quarterly budget

- Provider-held unspent funds

- Home Care Account

AT-HM funding:

- Provider-held unspent funds

- Home Care Account

- Participant AT-HM funding

We also want to make it easier for you to see client contribution balances, so the accounts screen has been updated to reflect this.

With the Aged Care Provider Portal API now available, Lookout will no longer calculate fund consumption manually. Instead, accounts are updated automatically after each claim reconciliation, giving you the most accurate and up-to-date view of your clients’ balances.

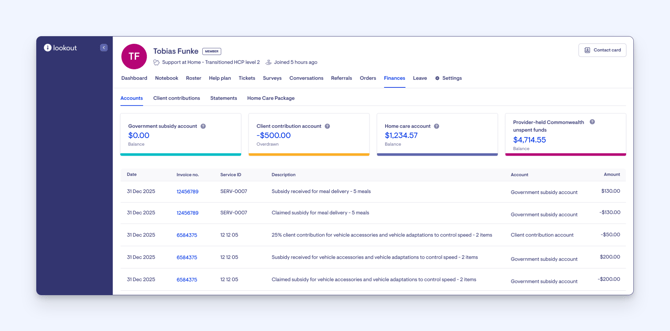

New accounts - transitioned HCP Member

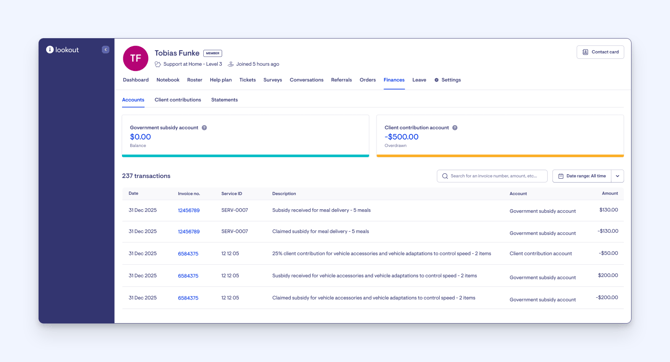

New accounts - SaH Member

Account breakdowns

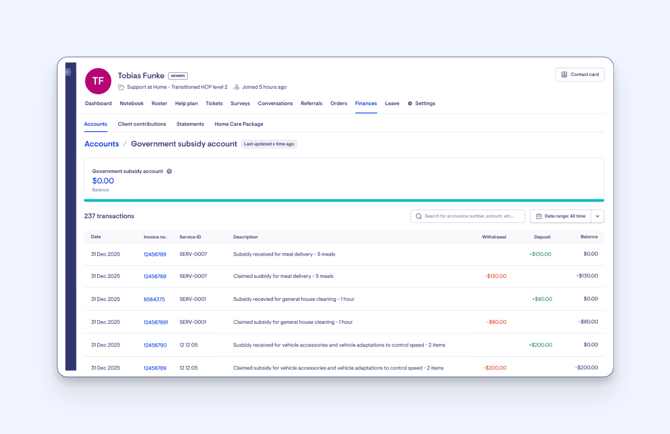

Government subsidy account

This account will look similar to the Care and Services account, with a few key differences:

Transactions appear only after the Support at Home claim and reconciliation are complete. The account will show:

- The amount invoiced to Services Australia

- The amount received from Services Australia

- The account balance should always reflect $0.

- Deposits and withdrawals are grouped together for clarity, displayed in red and green.

Unlike before, transactions will no longer be populated by billing runs, so all activity is based on completed claims and reconciliations.

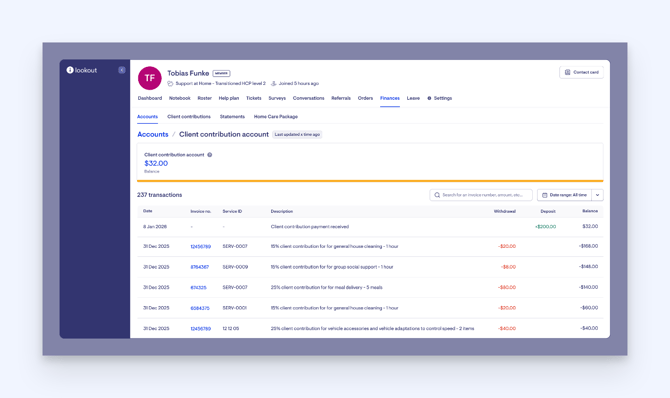

Client contributions

This account will continue to work much like it does today, with the following key points:

- Populates automatically with the mandatory client contribution amounts as advised by Services Australia.

- Reflects overspend: If a member has used all their available funds, Services Australia will return a higher contribution percentage, which will be shown here.

- Providers should add transactions once payment is received from members to maintain an accurate accounts receivable position.

- Visible to members: Account balances and transactions will be accessible to members through their app and statements.

Additionally, a separate Client Contributions report will be available to show amounts owed, which can be imported into your finance system for easier tracking.

Home Care and Provider Held Commonwealth Funds accounts

These accounts continue to reflect residual government and provider-held funds from Home Care Packages.

- Updated automatically: After each claim and reconciliation, Services Australia will return the updated balance via the API if funds are used from either account.

- Opening balance: The final provider-held funds balance reported to Services Australia in your October claim will become the opening balance for the new cycle.

Important: Make sure all reconciliations are up to date before October to ensure accurate reporting.

For more information on using Services Australia funding sources, click here.

FAQs

When looking at Support at Home (transition) members, why do some display the client contribution amount as 0%, while others do not show it at all?

Some client contribution details are currently missing due to gaps in the data being returned through the current Services Australia process. Currently, Lookout is set up with the following logic:

- We check whether there are any current or upcoming client contributions for the funding source.

- If contribution information is returned, we display it.

- If no contribution information is returned, nothing is shown.