The Home Care Package tab in Memberships

A guide to understanding and using the Home Care Package tab in Memberships.

What is the Home Care Package tab in Memberships?

The Home Care Package tab is the place in a Membership where financial information related to a client's Home Care Package lives.

There are three sub-tabs inside the Home Care Package tab:

-

Projected balance

-

Accounts

-

Statements

Jump to...

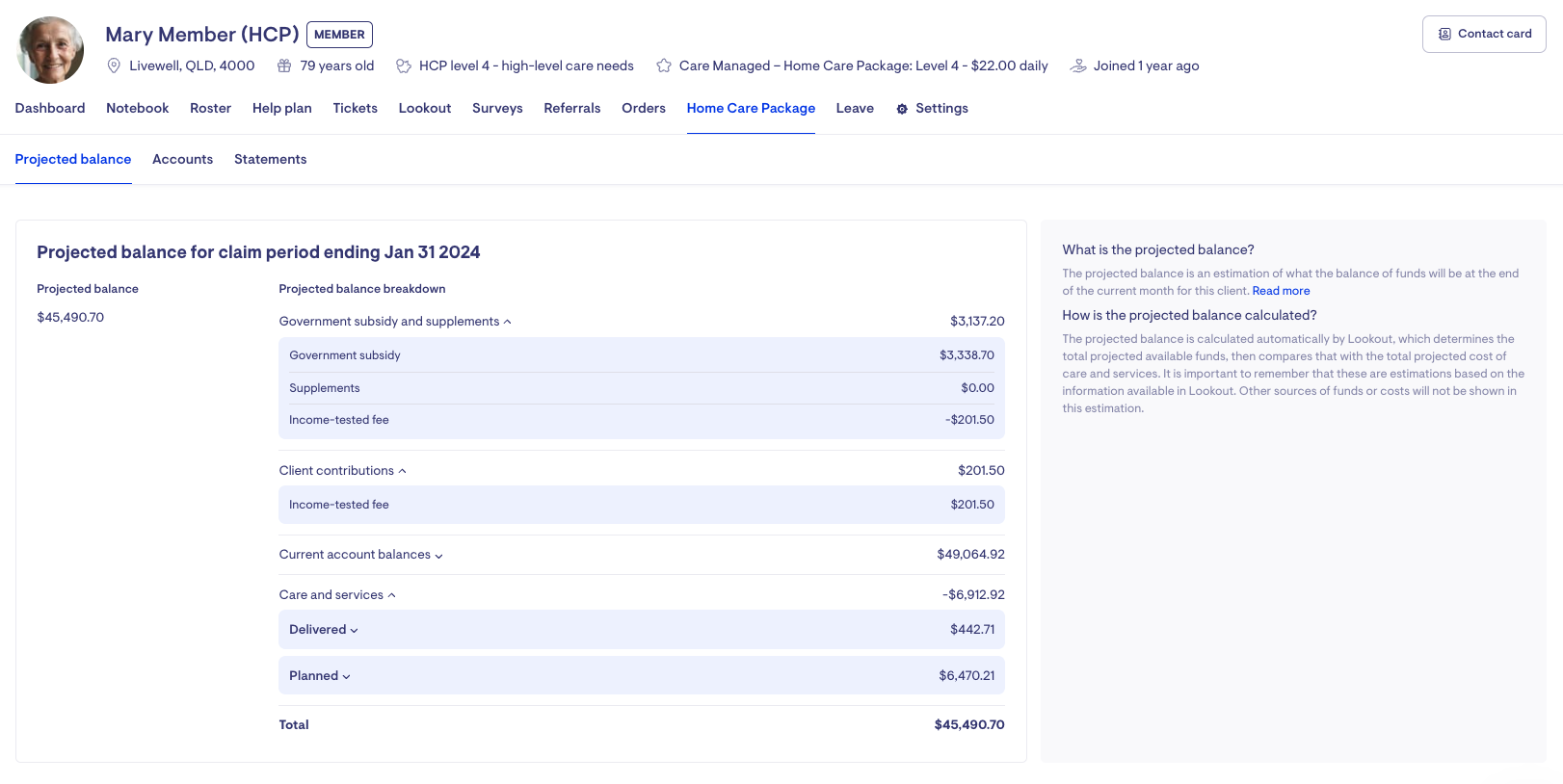

Projected balance

The projected balance sub-tab provides information about the projected balance for the client for the current month as well as a list of recent transactions.

The projected balance is enabled once a Home Care Package claim has been created.

What is the projected balance?

The projected balance is an estimation of what the balance of funds will be at the end of the current month for a client. The estimation is a calculation that compares the projected available funds against the projected cost of care and services.

How is the projected balance calculated?

Lookout calculates the projected balance by working out the total projected available funds, then comparing that with the total projected cost of care and services. It is important to remember that these are estimations based on the information available in Lookout. Other sources of funds or costs will not be shown in this estimation.

Example: client Pat Lee

Total projected available funds = $1860

Projected cost of care and services = -$470

Projected balance = $1390

How is the total projected available funds amount calculated?

The projected available funds amount is the total of the expected Government subsidy and supplements for the month plus the total amount of unspent funds available.

The total expected Government subsidy and supplements for the month is calculated using the daily rates of the HCP subsidy and any supplements, multiplied by the number of days in the month.

Example: client Pat Lee

HCP subsidy = $10 per day

ABC supplement = $2 per day

Month = 30 days

Expected Government subsidy and supplements = ($10+$2)x30 = $360

The total amount of unspent funds available is calculated by summing the current balances of each of the client's Home Care Package accounts together.

Example: client Pat Lee

Client contribution account = $0

Home care account = $250

Income tested fee account = $300

Provider-held Commonwealth funds account = $950

Available unspent funds = $0+$250+$300+$950 = $1500

The total expected Government subsidy and supplements for the month and the total amount of unspent funds available are then summed together to give the total projected available funds amount.

Example: client Pat Lee

Expected Government subsidy and supplements = $360

Available unspent funds = $1500

Total projected available funds = $1860

How is the projected cost of care and services calculated?

The projected cost of care and services is the total cost of all the care and services for the month. This includes the care and services already delivered as well as the planned items Lookout knows about.

The projected cost of care and services is the sum total of the following:

-

All items invoiced in the month so far, which appear as part of the total balance of the care and services account

-

All pending purchase orders:

-

all purchase order lines without an estimated delivery date, and

-

any purchase order lines with an estimated delivery date that is before the end of the current HCP Claim period.

-

-

Any planned future visits left in the month

-

Any package management fees still to be charged in the month

-

Any care management fees still to be charged in the month

Example: client Pat Lee

Current care and services account balance = -$200

Total of outstanding purchase orders = -$50

Total of planned future visits (in the month) = -$100

Total of package management fees to be charged (in the month) = -$55

Total of care management fees to be charged (in the month) = -$65

Projected cost of care and services = (-$200)+(-$50)+(-$100)+(-$55)+(-$65) = -$470

Suggestions for using the projected balance

The projected balance can help you understand the likely available balance for your client so that you can plan their care and avoid overspending. This estimate does not replace a care plan budget but can help you to manage funding planning, including:

-

avoid overspends inside a claim month

-

understand the breakdown of available funding

-

track that you are building up funds for large purchases (if needed)

-

have visibility of funding availability in exceptional months (e.g. 5-week months)

The accuracy of the projected available balance depends on the information in Lookout related to funding and costs. The more up-to-date you keep this information, the better the estimation.

Users of the care app can also see a simplified version of the estimated projected balance. You can read more about this view in this article.

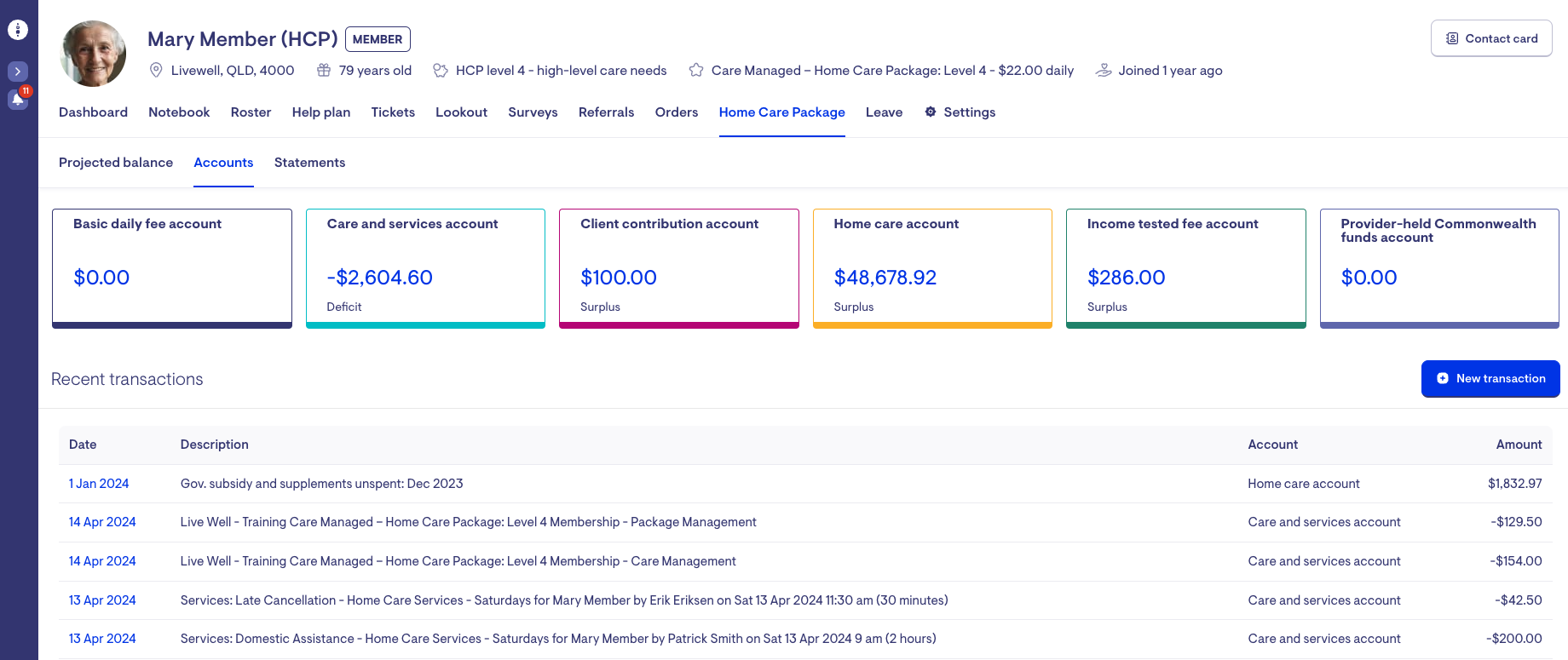

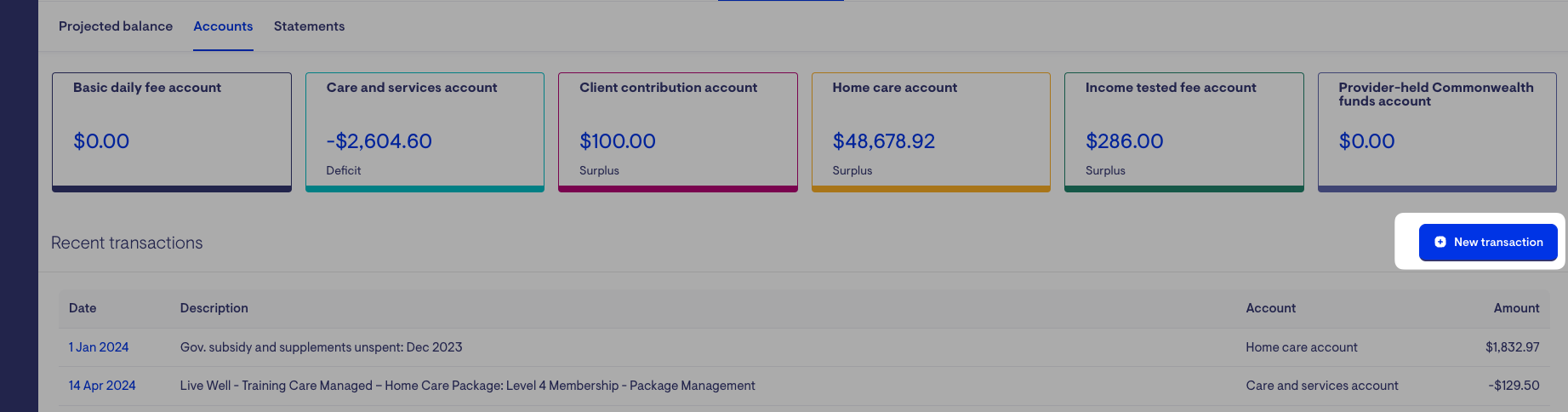

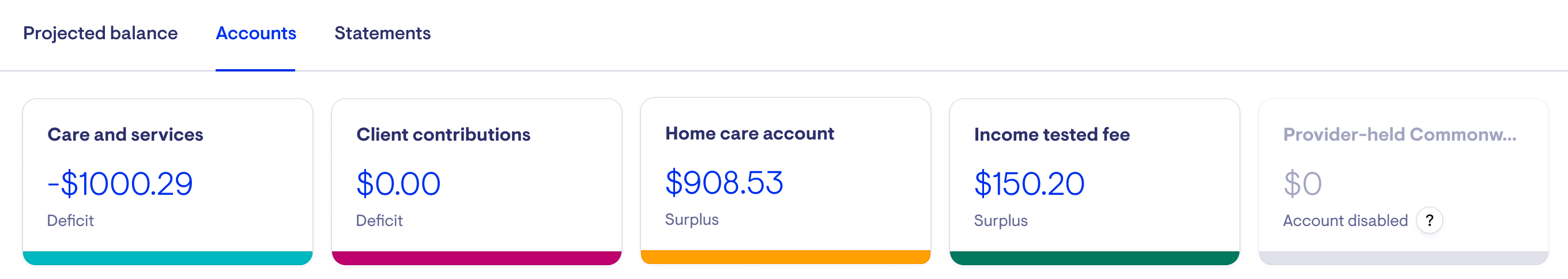

Accounts

The accounts sub-tab provides an overview of the different financial accounts affiliated with the client's home care package and a summary list of recent transactions across all of the accounts.

There are six accounts:

-

Basic daily fee account

-

Care and services account

-

Client contributions account

-

Home care account

-

Income-tested fee account

-

Provider-held Commonwealth funds account

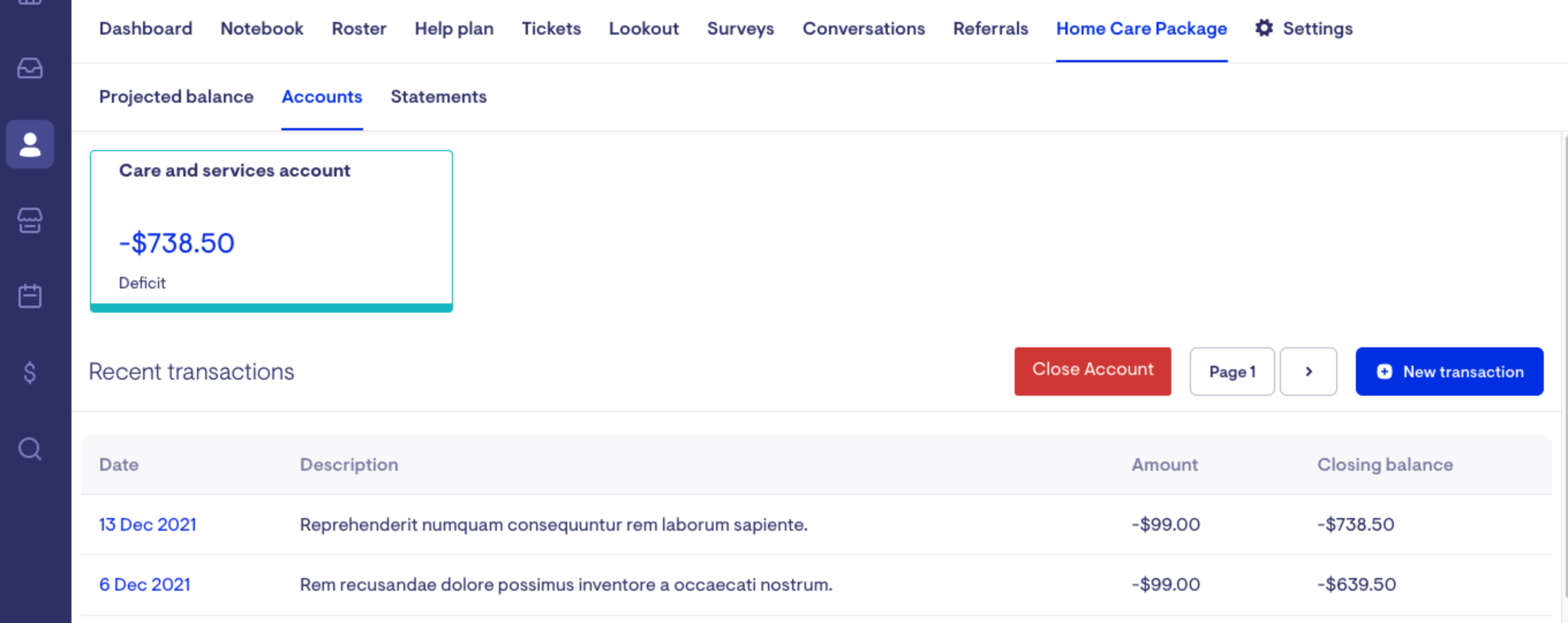

Clicking on any individual account will take you to a focused view of that account.

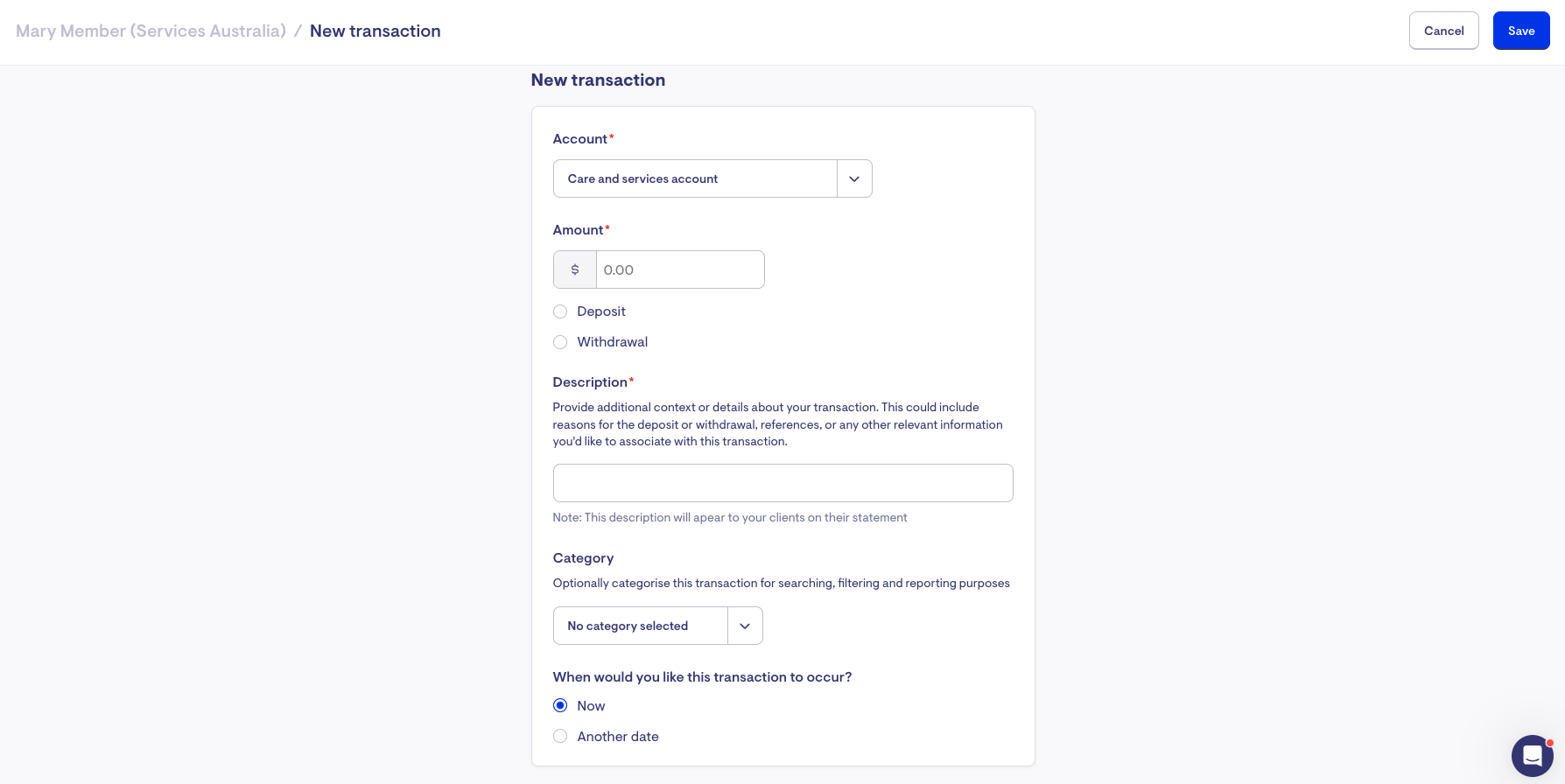

Adding a New Transaction

You can create a transaction into any of these accounts by clicking the "New transaction" button.

Be sure to select the correct account for any transactions you create in this way. You'll also want to give a description that will make sense to the client since the description will be on their monthly statement.

If you need to load multiple transactions on different memberships simultaneously, you can do an account transaction import.

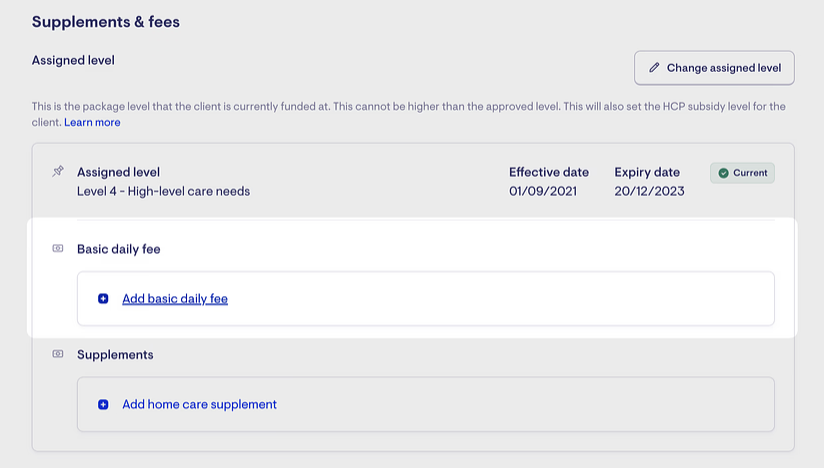

The Basic Daily Fee account

This account is where the Basic Daily fee (BDF) gets recorded, if applicable. The BDF refers to a home care fee that a care recipient may be asked to pay by a home care provider based on their package level (separate from the Government subsidy).

To define the BDF, go to the Supplements & Fees section on the Membership's page.

The Care and Services account

This is the account where the costs of all care and services need to be recorded. The end-of-month balance of this account is used to calculate the claim amount you will submit to Services Australia. You can think of this account as the debit account for everything which will make up your HCP claim for this client.

A number of transactions will be created automatically into this account:

-

all the invoices created through billing runs

-

package and care management fees you have set up

-

any transactions resulting from finalising a monthly claim in Lookout, generally a credit

Any additional transactions you wish to apply to this account must be created manually.

The Client Contributions account

The client contribution account is designed to be used to:

-

Track and manage any payments made by the client for care and services beyond the scope of their HCP package (by prior agreement).

-

Enable costs that exceeded a monthly HCP payment from all sources to be identified and managed.

Any transactions resulting from finalising a monthly claim in Lookout which affect this account will be generated automatically. These transactions will generally be a withdrawal from this account. Any additional transactions you wish to apply to this account must be created manually.

The Home Care account

The home care account is intended to be a reflection of the Home Care Account managed by Services Australia on behalf of the client. The Home Care Account is the account used to track any unspent Commonwealth funds available to this client which are maintained by Services Australia. The Home Care Account was introduced as a part of the Improved Payment Arrangements (IPA) reform implemented in 2021.

Any transactions resulting from finalising a monthly claim in Lookout which affect this account will be generated automatically. Any additional transactions you wish to apply to this account must be created manually. This includes any adjustments advised by Services Australia, including through the monthly payment summary, such as:

-

transfer of funds from a previous provider

-

adjustments from a prior period

-

adjustments due to a change in package level (subsidy), supplements, or assessed income-tested care fees*

*If an adjustment is required due to a change in package level, supplements, or income-tested care fee, you will need to add or update the changed subsidy, supplement or fee as well as apply the adjustment. Doing so will align the calculations for future claims.

The Income-tested fee account

The income-tested fee account is intended to manage the record of funds that have been collected as income-tested care fees (ITF) but which are not used in the month in which they are collected. Examples of these funds include:

-

The client-contribution portion of unspent funds that were collected as ITFs prior to 1 September 2021.

-

Any residual ITF funds left over after all care and services for the month are paid in full. (This will only occur if the total cost of care and services in a month is less than the value of the assessed ITF for that month.)

-

Any adjustments due to a back-dated adjustment to an ITF.*

*If an adjustment is required due to a change in ITF, you will need to add or update the ITF as well as apply the adjustment. Doing so will align the calculations for future claims.

This account will not show a monthly transaction related to the current month's assessed ITF. Instead, the current daily rate for an ITF recorded in Lookout is used in the calculations finalising a monthly HCP claim, in line with the calculations used by Services Australia. Any transactions resulting from finalising a monthly claim in Lookout which affect this account will be generated automatically. These transactions will be a withdrawal from this account, except in the situation where residual ITF funds are left over after all care and services are paid for within a month. Any additional transactions you wish to apply to this account must be created manually.

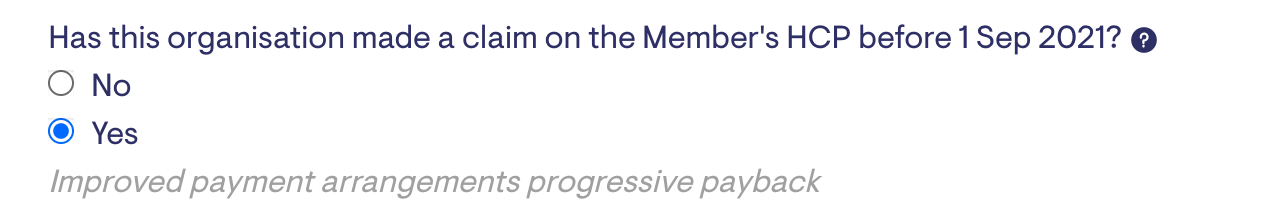

The provider-held Commonwealth funds account

The provider-held Commonwealth funds account is intended to manage the record of Commonwealth unspent funds held by the provider for this client. In line with the Improved Payment Arrangements (IPA) reform implemented in 2021, this account is only set up for clients who were in your care prior to 1 September 2021. Be sure to select the correct option when initially setting up the funding scheme for a membership.

If this option is set to "no" then the provider-held Commonwealth funds account will be disabled.

Any transactions resulting from finalising a monthly claim in Lookout which affect this account will be generated automatically. These transactions will be a withdrawal from this account. Any additional transactions you wish to apply to this account must be created manually.

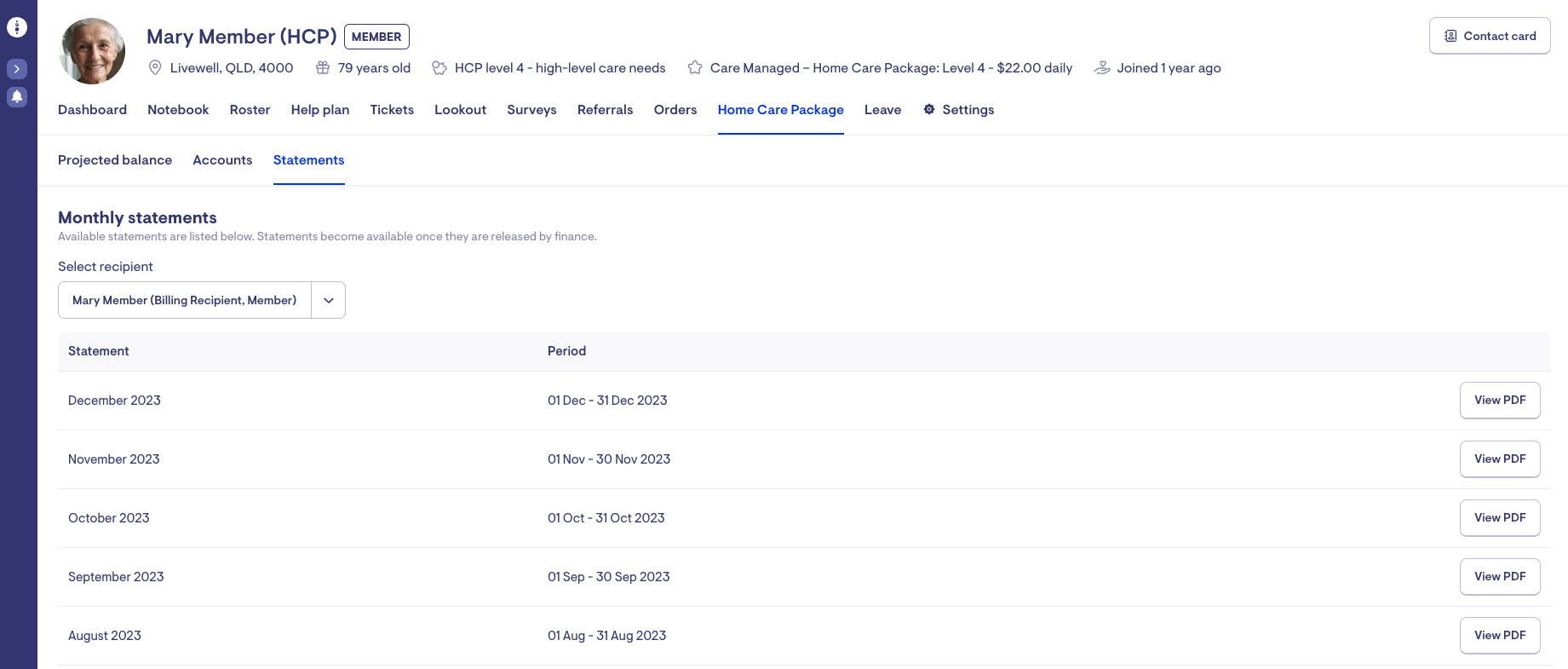

Statements

What are monthly statements?

Lookout will automatically generate statements for HCP clients once a claim has been finalised. These statements can be sent out via email, post, or viewed through the client app. You can also access them through the statements area in admin.

Only statements for months that have had their HCP claim finalised will appear in the available list.

Learn more about understanding the HCP monthly statement here.

Accessing a statement in admin

When you click on 'view PDF' for an available statement, a PDF copy of that month's statement will be generated. You can view the PDF in the browser or download a copy for your records or to provide to a client.